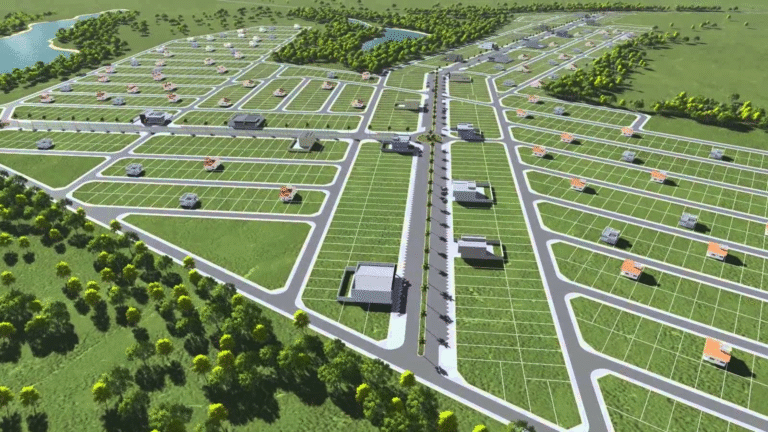

Hyderabad continues to attract investors due to steady infrastructure growth, job creation, and expanding city limits. If you plan to invest in Hyderabad in 2026, location selection and asset type matter more than timing. Buyers now focus on plotted developments, peripheral growth zones, and areas linked to major road networks. These zones offer better entry pricing and long-term appreciation.

Why Hyderabad Remains a Strong Investment Choice?

Hyderabad shows stable demand across residential and land segments. The city benefits from IT expansion, pharma clusters, and logistics hubs. Government-led projects support balanced growth instead of concentrated development.

Key reasons investors prefer Hyderabad:

- Consistent property demand

- Lower volatility compared to metro peers

- Strong migration for employment

- Infrastructure-led expansion

Top Localities to Invest in Hyderabad in 2026

1. Sadasivpet

Sadasivpet stands out for land investment in Hyderabad. Proximity to NH-65 and industrial zones attracts long-term investors. Plotted developments here offer a lower entry cost with future growth potential.

Also Read: Why Sadasivpet is an Emerging Real Estate Hub in Telangana?

2. Shankarpally

Shankarpally connects well to IT corridors and western Hyderabad. Demand rises due to educational institutions and villa communities. This area suits buyers looking for plots in Hyderabad for investment.

3. Tellapur and Kollur

These zones benefit from proximity to the Financial District and ORR. Property prices have risen steadily. Demand remains strong for residential plots and villas.

4. Adibatla

Adibatla gains attention due to aerospace and industrial development. Employment growth supports residential demand. This area fits buyers focused on appreciation over rental yield.

5. Medchal and Kompally Belt

North Hyderabad grows due to industrial parks and logistics hubs. Connectivity to highways increases land value. These zones attract budget and mid-range investors.

Best Residential Areas in Hyderabad for Long-Term Returns

Residential buyers target areas offering access, social infrastructure, and future connectivity. In 2026, the best residential areas in Hyderabad include:

- Sadasivpeth

- Nallagandla

- Bachupally

- Miyapur outskirts

- Uppal growth corridors

These zones support both end-use and rental demand.

Hyderabad Real Estate Hotspots Driven by Infrastructure

Infrastructure shapes Hyderabad’s real estate hotspots. Projects influencing growth include:

- Regional Ring Road

- Metro line extensions

- New flyovers and radial roads

- Industrial corridors

Areas aligned with these projects see higher land absorption and price growth.

Hyderabad Property Price Trends 2026

Market indicators suggest moderate but stable growth. Prices rise faster in plotted developments compared to apartments due to limited supply and buyer preference.

Key trends:

- Peripheral plots show higher appreciation potential

- Approved layouts outperform unapproved land

- Demand shifts towards low-density developments

Why Plots Remain a Preferred Investment?

Plots in Hyderabad for investment offer flexibility. Buyers face lower maintenance costs and fewer regulatory restrictions. Land assets respond well to infrastructure announcements and zoning changes.

Benefits include:

- Higher long-term appreciation

- Lower holding cost

- Easier resale

- Clear ownership structure

Conclusion

Choosing where to invest in Hyderabad in 2026 depends on infrastructure access, approval status, and long-term development plans. Growth corridors and plotted layouts offer stronger value compared to saturated city zones. SVG Developers focus on well-planned projects in emerging areas, aligning with future infrastructure and buyer demand. Such developments support stable returns and secure ownership for long-term investors.

FAQs

1. Is 2026 a good time to invest in Hyderabad?

Yes. Infrastructure expansion and demand growth support steady returns.

2. Which areas offer the best land investment potential?

Sadasivpet, Shankarpally, Adibatla, and Medchal show strong potential.

3. Are plots better than apartments for investment?

Plots offer higher appreciation and lower maintenance costs.

4. What approvals should buyers check before investing?

HMDA or DTCP approval, clear title, and valid registration records.

5. How does infrastructure affect property returns?

Roads, highways, and metro projects increase demand and land value.