NRIs invest in real estate in Hyderabad due to stable growth, strong rental demand, and legal clarity. The city offers lower entry prices compared to Mumbai and Bengaluru. It also shows steady appreciation across plotted and residential segments.

For NRIs seeking long-term wealth creation, Hyderabad delivers both safety and predictable returns.

Why Hyderabad Attracts NRI Investors?

1. Stable Market Growth

Hyderabad shows consistent price growth without extreme volatility. Demand remains strong due to IT expansion and industrial growth.

2. Lower Entry Cost Compared to Other Metros

Property prices in Hyderabad remain affordable compared to Mumbai, Delhi, and Bengaluru.

This gives NRIs a higher value per rupee invested.

3. Strong Rental Demand

Rental income from Hyderabad property stays stable due to job migration. Areas near IT hubs and industrial parks offer reliable tenants.

Benefits of NRI Investing in India

NRIs prefer India for long-term real estate investment because:

- High appreciation potential

- Lower asset volatility

- Rupee depreciation advantage

- Tangible asset ownership

- Portfolio diversification

These benefits make Indian property a safe wealth store.

NRI Rules for Buying Property in India

NRIs can buy:

- Residential property

- Commercial property

- Plots with approved layouts

NRIs cannot buy agricultural land or plantation land.

Payments must come through:

- NRE account

- NRO account

- FCNR account

Property registration must follow local stamp duty rules.

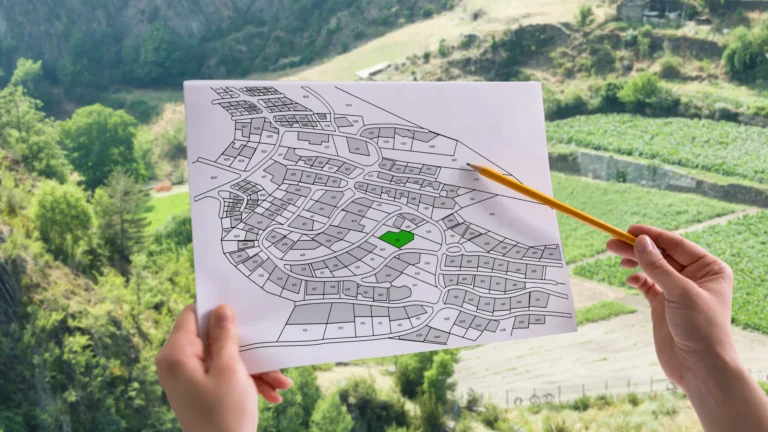

NRI Investment Opportunities in Hyderabad

Hyderabad offers multiple options:

1. Open Plots

Plots suit NRIs focused on appreciation. They require low maintenance and offer flexible resale.

2. Apartments

Apartments suit rental income goals. They offer a steady monthly cash flow.

3. Villas

Villas attract premium tenants. They suit lifestyle and resale goals.

High Appreciation Projects in Hyderabad

Projects near infrastructure corridors show faster value growth.

Key growth drivers:

- ORR connectivity

- Metro expansion

- Regional Ring Road

- Industrial corridors

Buyers prefer approved layouts near these zones.

Best Areas in Hyderabad for NRI Investors

- Sadasivpet

- Shankarpally

- Tellapur

- Kollur

- Adibatla

- Kompally

These areas combine access, affordability, and future demand.

Tax Benefits for NRI Property Investment

NRIs get:

- Deduction on home loan interest

- Capital gains exemptions under Section 54

- Indexation benefits on long-term gains

Proper tax planning improves net returns.

Conclusion

NRIs invest in real estate in Hyderabad because the city offers stable appreciation, legal safety, and rental demand.

Long-term infrastructure growth strengthens value. SVG Developers focus on approved projects in growth corridors that suit NRI investment goals. Such locations support predictable appreciation and secure ownership.

FAQs

1. Can NRIs buy property in Hyderabad

Yes. NRIs can buy residential and commercial property.

2. Is Hyderabad safe for NRI investment?

Yes. The city shows stable growth and strong demand.

3. Which asset type suits NRIs best?

Plots suit appreciation. Apartments suit rental income.

4. What payment mode must NRIs use?

Payments must come through NRE or NRO accounts.

5. Why choose approved layouts for NRI investment?

They offer legal safety and better resale value.