Renting vs buying is one of the biggest financial decisions for working professionals and families. In 2026, rising rents, changing lifestyles, and long-term property appreciation make this choice even more important.

What works for one person may not work for another. The right option depends on income stability, long-term plans, and investment goals.

Let’s explore renting vs buying in 2026 using cost, flexibility, and wealth creation factors.

Understanding Renting in 2026

Renting offers flexibility and lower upfront costs. Many people choose rent due to job mobility and short-term plans.

Advantages of Renting

- No large upfront investment

- Easy relocation

- No maintenance responsibility

- Suitable for short-term stay

Limitations of Renting

- Rising rental costs every year

- No asset ownership

- No protection against long-term inflation

- Rent paid does not create wealth

In major cities, rental inflation continues to rise faster than salary growth.

Understanding Buying Property in 2026

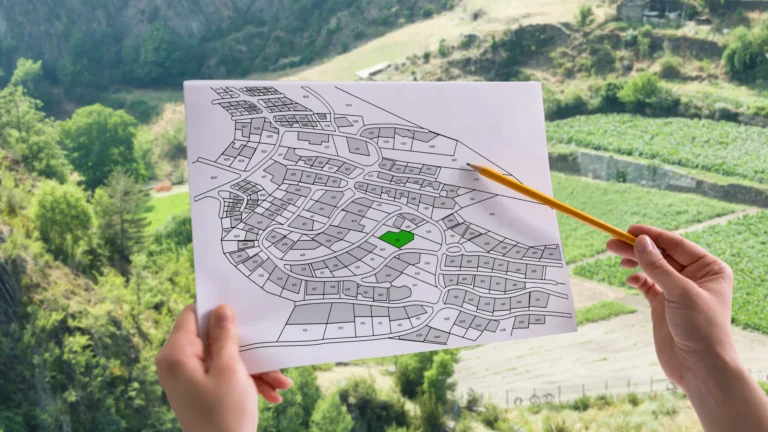

Buying property creates long-term stability and ownership. In 2026, buyers focus more on land, plotted developments, and peripheral growth zones.

Advantages of Buying

- Asset ownership

- Protection against rent inflation

- Long-term appreciation

- Emotional and financial security

Challenges of Buying

- Higher upfront cost

- Registration and tax expenses

- Long-term financial commitment

However, buying early in a growth corridor improves affordability and returns.

Cost Comparison: Renting vs Buying

Renting appears cheaper in the short term. Buying becomes cost-effective in the long run.

Key cost points:

- Rent increases annually

- Home loan EMI stays predictable

- Property value grows over time

- Owned property reduces future housing expense

For people planning to stay in one city for more than 5 to 7 years, buying often makes financial sense.

Renting vs Buying: Lifestyle Factors to Consider

Renting suits people who:

- Change cities often

- Prefer flexibility

- Have uncertain job location

Buying suits people who:

- Plan long-term settlement

- Want stability for family

- Aim for asset creation

Lifestyle clarity helps avoid regret later.

Investment Perspective in 2026

From an investment view, buying creates long-term value. Residential plots and approved layouts offer better appreciation than rental-heavy apartments.

Key trends in 2026:

- Demand for low-density developments

- Preference for plotted communities

- Growth in outskirts linked to highways

- Higher resale demand for approved projects

Buying in the right location builds wealth over time.

When Renting Makes More Sense?

Renting works better when:

- Stay duration is short

- Income is unstable

- Down payment funds are limited

- City choice is temporary

Renting is a lifestyle decision, not an investment decision.

When Buying Makes More Sense?

Buying works better when:

- Long-term stay is planned

- EMI is close to current rent

- Location has future growth

- Property has clear approvals

Buying early reduces future price pressure.

Read More: Where to Invest in Hyderabad in 2026 for Maximum Property Returns?

Conclusion

Renting vs buying in 2026 depends on your time horizon and financial clarity. Renting offers flexibility. Buying offers stability and wealth creation. Investors and end-users increasingly prefer land and plotted developments due to appreciation and low maintenance.

SVG Developers focus on planned, approved projects in growth corridors, helping buyers convert ownership into long-term financial strength.

FAQs

1. Is renting cheaper than buying in 2026?

Renting is cheaper short term. Buying costs less over long periods.

2. How long should I stay to justify buying?

Five to seven years makes buying more effective.

3. Is buying property risky in 2026?

Risk reduces with approved layouts and good locations.

4. Should first-time buyers rent or buy?

Buy if long-term plans are clear.

5. What property type suits buying in 2026?

Residential plots offer strong appreciation and flexibility.