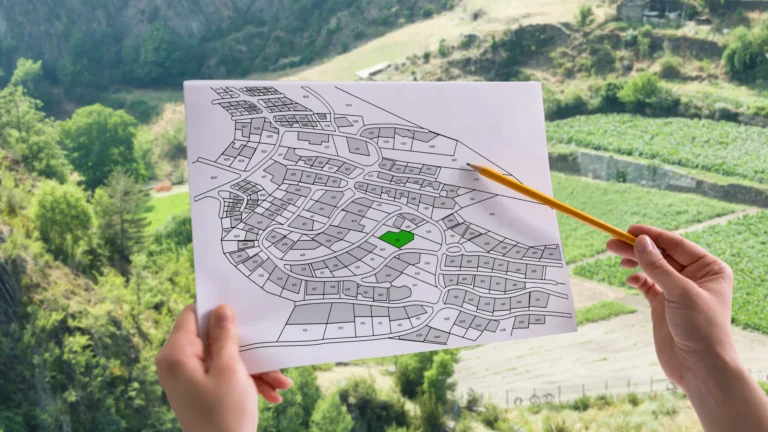

Plot investment can be one of the smartest ways to build wealth—if done wisely. However, first-time plot investors’ journey from decision-making to purchase can be riddled with uncertainties.

This guide brings clarity and confidence to that process, especially for those exploring plot investment in Hyderabad, one of India’s hottest real estate markets.

Why Plot Investors Should Take the Leap?

The rising land value in India has made plot investment an increasingly attractive option. For many, it’s a gateway into real estate with lower entry costs and higher flexibility than apartments or villas.

But why are plot investors becoming more confident today?

- Appreciation Potential: Unlike built-up properties that depreciate due to wear and tear, land appreciates over time.

- Flexibility in Use: Whether you want to build a home, start a farm, or just hold it for value appreciation, land gives you choices.

- Minimal Maintenance: There’s no tenant turnover or structural maintenance, reducing the long-term costs.

This has led to a surge in land investors in India, especially in developing metro peripheries.

What Makes Plot Investment in Hyderabad So Appealing?

If you’re Googling “plot investors near me” or “top locations for plot investment,” Hyderabad should definitely pop up. And here’s why:

- Strategic Infrastructure Growth: Areas like Sadasivpet and Shankarpally are transforming rapidly due to upcoming metro lines and proximity to the Mumbai Highway.

- IT Boom: The expanding IT hubs are pushing residential and commercial growth to the city’s outskirts.

- Affordable Entry Points: Compared to Bengaluru or Mumbai, plot prices in Hyderabad remain relatively accessible.

Because of these reasons, many plot investors in India are shifting focus to Telangana.

Is Plot Investment Good or Bad?

Pros:

- Higher returns on long-term holding.

- Less capital-intensive than apartment investment.

- Ownership of a tangible, visible asset.

Cons:

- Liquidity can be lower compared to built properties.

- Requires thorough due diligence on legal documents and zoning.

So, is plot investment good or bad? It’s good—if you do your homework.

Tips for First-Time Plot Investors to Navigate Confidently

Here’s a breakdown of actionable insights to help first-time plot investors make informed choices:

Understand the Zoning and Regulations

Before you buy, confirm the land use classification—whether it’s residential, commercial, or agricultural. Municipal or local planning permissions play a significant role.

Check the Legal Clearances

Make sure the plot has:

- Title deed in the seller’s name.

- Encumbrance certificate.

- Approved layout from DTCP or HMDA.

Without these, even the best plot investment can turn sour.

Location is Not Just Geography, It’s Strategy

Look for plots in areas with upcoming infrastructure, such as:

- Highways

- Railway lines

- Tech parks

- Education hubs

These factors directly boost plot investment returns over time.

Evaluate the Developer’s Reputation

Research developers or brokers thoroughly. Search for best plot investors and developer reviews online. Trusted names like SVG Developers in Hyderabad are gaining momentum for a reason—they deliver value with transparency.

Plan Your Investment Horizon

Plot investment is not a get-rich-quick scheme. It’s a long game. You need to:

- Define your time horizon.

- Decide whether it’s for self-use or resale.

- Understand tax implications (capital gains, stamp duty, registration fees).

Choose the Right Size and Budget

Avoid over-leveraging. Choose a plot that fits your budget while leaving room for other financial goals. Small plots in growing areas can deliver better percentage returns than big-ticket buys in saturated zones.

Keep an Eye on Market Trends

Stay informed about:

- Government infrastructure projects

- Policy changes like RERA

- Real estate cycles

Smart plot investors adapt their strategies accordingly.

Consider Gated Layouts for Extra Security

First-time investors often worry about encroachment and land disputes. Plots in gated layouts offer security, amenities, and better resale value.

Why SVG City is a Prime Choice for Plot Investment in Hyderabad?

Located strategically in Sadasivpet along the Mumbai Highway, The SVG City by SVG Developers offers an exceptional opportunity for plot investors looking to enter the Hyderabad real estate market.

Here’s why it stands out:

- DTCP-approved layout with clear legal documentation.

- Close proximity to the Regional Ring Road (RRR), boosting connectivity.

- Gated community with amenities like parks, drainage, and streetlights.

- Reasonable pricing that suits both first-time and seasoned plot investors in India.

Whether you’re a cautious beginner or a seasoned land investor in India, SVG City offers both security and returns. It is undoubtedly one of the top plot investment choices today.

FAQs

Is plot investment in Hyderabad a good choice for beginners?

Absolutely. The city’s infrastructure and development growth make it ideal for first-time plot investors.

How long should I hold a plot to see returns?

Ideally 3 to 5 years, although some areas appreciate sooner due to sudden infrastructure projects.

What documents should I verify before buying a plot?

Title deed, encumbrance certificate, layout approvals (DTCP/HMDA), and tax receipts.

Can I finance a plot purchase with a home loan?

Yes, many banks offer loans for plot purchases, especially if it’s DTCP or HMDA-approved.

Are gated community plots better for investment?

Yes, they offer legal clarity, community features, and better appreciation potential.